We then arrive at the cash version of a company’s net income. What is added or subtracted are changes in the account balances of items found in current assets and current liabilities on the balance sheet, as well as non-cash accounts (e.g., stock-based compensation). It starts with net income or loss, followed by additions to or subtractions from that amount to adjust the net income to a total cash flow figure. The cash flow statement begins with Cash Flow from Operating Activities. This guide will give you a good overview of what to look for when analyzing a company. While each company will have its own unique line items, the general setup is usually the same.

#CASHFLOWS FORMATS DOWNLOAD#

Download the Free TemplateĮnter your name and email in the form below and download the free template now!īelow is a breakdown of each section in a statement of cash flows. In contrast, the cash flow statement only recognizes cash that has actually been received or disbursed. The reason for the difference between cash and profit is because the income statement is prepared under the accrual basis of accounting, where it matches revenues and expenses for the accounting period, even though revenues may actually not have yet been collected and expenses may not have yet been paid.

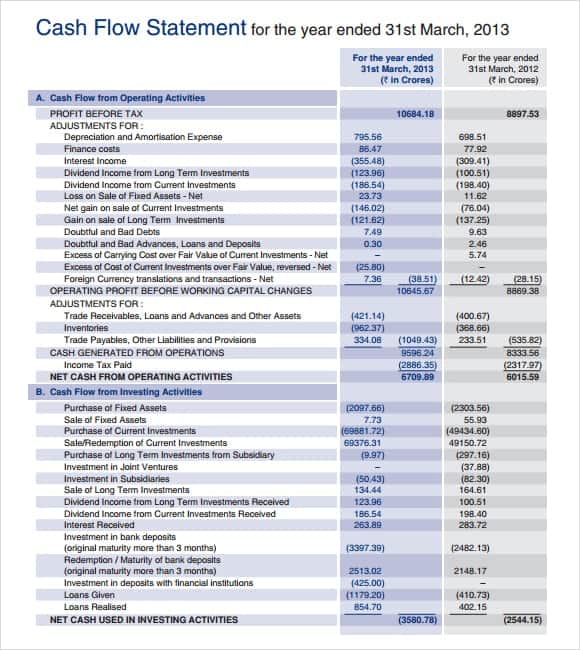

The cash flow statement reflects the actual amount of money the company receives from its operations. This comparison helps company management, analysts, and investors to gauge how well a company is running its operations. One of the primary reasons cash inflows and outflows are observed is to compare the cash from operations to net income. The total cash provided from or used by each of the three activities is summed to arrive at the total change in cash for the period, which is then added to the opening cash balance to arrive at the cash flow statement’s bottom line, the closing cash balance. The main categories found in a cash flow statement are (1) operating activities, (2) investing activities, and (3) financing activities of a company and are organized respectively. It is one of the main financial statements analysts use in building a three statement model. On the other hand, any decrease in the value of current assets gets added to the net income, and an increase in current assets is reduced from the net income.Updated MaWhat is the Cash Flow Statement?Ī Cash Flow Statement (also called the Statement of Cash Flows) shows how much cash is generated and used during a given time period. In this method of accounting, the revenue gets recognized when it is earned, irrespective of when it is received.Īny increase in the current liabilities is added to the net income, whereas any decrease in current liabilities is reduced from the net income. The accountant then uses the backward computation method to bring the cash basis figure for the accounting period. The computation starts with the net income figure based on the accrual accounting approach. Indirect Method: The indirect method uses the accrual method of accounting. The direct method of computing CFO includes:Ĭash payments made to suppliers and vendors There are two methods of computing CFO – the direct method and the indirect method.ĭirect Method: Under the direct method approach, all the transactions are recorded on a cash basis and the information is shown on the cash flow statement with actual cash outflows and inflows during a given period. CFO can also be used as a benchmark to ascertain the financial health of a company’s core activity. It includes activities like manufacturing and sales while excluding capital expenditure or long-term investments. The first part of the cash flow statement is the cash flow from operating activities (CFO).

0 kommentar(er)

0 kommentar(er)